US regulator warns against increase in online paid stock-promotion campaigns.

On January 18 2012, an article appeared on Seeking Alpha, the finance-focused website, entitled “Another revival could be in store for ImmunoCellular Therapeutics”. The article highlighted the US drug company’s work in developing an experimental cancer treatment.

But readers were not informed that ImmunoCellular Therapeutics had paid the author, Vincent Cassano, indirectly to produce the story, according to documents filed at a court in New York by the US regulator in April.

The article suggested that ImmunoCellular Therapeutics had produced an important cancer treatment, known as ICT-107, which was less costly than a rival product that had already received approval from US regulators.

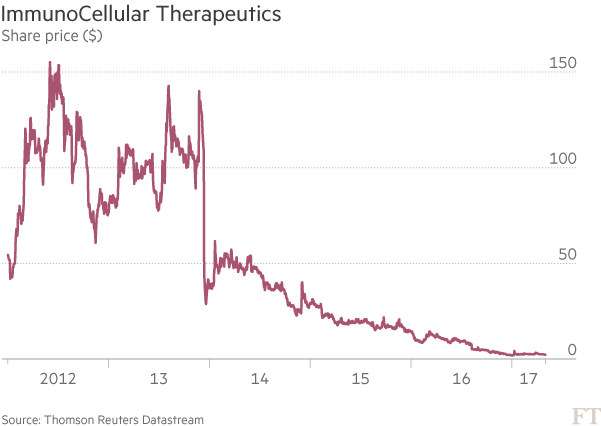

In the months that followed, ImmunoCellular Therapeutics’ share price rose strongly, from $42.8 on the day before the article was published to an all-time high of $155.2 by the start of June 2012, a gain of 263 per cent.

However, following a disappointing clinical update on the ICT-107 cancer treatment in December 2013, the drug company’s share price fell sharply. Last week it was languishing at around $2.23.

The article was one of at least 200 that appeared without appropriate disclosure of payment on the Seeking Alpha website between August 2011 and March 2014, according to the US Securities and Exchange Commission.

A spokesperson for ImmunoCellular Therapeutics said it “co-operated fully” with the SEC’s investigation. A spokesperson for Seeking Alpha says the company also co-operated fully with the SEC, and that it supported the regulator’s efforts to put unethical stock promoters out of business.

The court documents show the regulator identified articles published without the appropriate disclosure of payment across a wide range of investment websites including Benzinga, Wall Street Cheat Sheet, TheStreet, MarketPlayground, Investor Village, Investing.com and Forbes, as well as Seeking Alpha.

Jim McCaughan, chief executive of Principal Global Investors, the $411bn Des Moines-based multi-boutique asset manager, says of the US watchdog’s findings: “It reminds me of The Wolf of Wall Street movie, but updated for the digital age. This is a more sophisticated online version of the old penny-stock scams, where non-existent companies were ramped up with fake new stories.”

The SEC has since filed charges of fraud against three public companies, seven communications businesses, two chief executives and nine writers for their involvement in what the US regulator described as a “sophisticated stock promotion scheme”.

Seventeen of those charged have already agreed to pay settlements or penalties ranging from $2,200 to nearly $3m.

The SEC continues to pursue action against 10 other individuals after this latest alleged attempt to manipulate stock prices through the dissemination of so-called fake news.