These aren’t the overpowered, overpriced American cannabis drinks known for giving people bad trips. That was the message from Canopy Growth (WEED.TO)(CGC) management on a guided tour of the company’s new beverage facility. They hope it will resonate with the first-time cannabis consumers they are banking on to be the main driver of sales in a category that has struggled to make an impact south of the border.

Canopy Growth revealed its initial offering of infused beverages and chocolates at an event held at its Smith’s Falls, Ont. headquarters on Tuesday. Product and innovation director Paul Weaver acknowledged data from BDS analytics showing drinks accounted for just one percent of cannabis revenue in California in August. He’s optimistic the Canadian reception will be different.

“We believe our industry will grow the category beyond just one percent,” he told event attendees as they sipped on non-infused versions of the company’s Tweed, Houseplant, Quatreau and Deep Space-branded drinks. “These products are built for success.”

RELATED: 12 Million THC Bottling Plant Completed. Updating Coverage on Tinley (TNY, TNYBF) Beverage.

Citing a survey done in partnership with beer giant and major stakeholder Constellation Brands (STZ), he said about 60 percent of current cannabis users answered “yes” when asked if they’re interested in pot beverages. That figure, he said, jumped to 80 percent among new, novice cannabis consumers.

“Our cannabis beverages are best designed for the most novice cannabis consumer. Someone who may have never been high in their entire life,” he said. “What makes us think that we can exceed that one percent opportunity? It’s this fundamental understanding of this novice consumer. Most importantly their fears about the category.”

Cowen cannabis and alcoholic beverage analyst Viven Azer said the U.S. market for cannabis drinks is small, fragmented, and without a clear leader. That’s the case, she said, because early products in states where cannabis sales are legal get people stoned for a long time, and lack consistent intensity, onset, and offset for the high users feel. They’re also expensive, she added.

“In the U.S., they are generally $10. That’s very, very high,” Azer told Yahoo Finance Canada. “You can get an edible with the same dosage for one or two dollars a serving.”

Three of the top five best selling cannabis beverage brands in U.S. states where sales are legal (excluding Washington) contained over 100 milligrams of psychoactive THC in August, according to BDS Analytics data. The best seller is Hi-Fi Hops, a 10 milligram per serving drink produced by Heineken (HEIA.AS) subsidiary.

Most of Canopy Growth’s new THC drinks contain two or 2.5 milligrams of THC per serving. The company’s Deep Space beverage is the only higher-potency product, with 10 milligrams per can.

Canopy Growth president Rade Kovacevic said their drinks are designed to kick in after about 20 minutes to mimic the familiar experience of drinking alcohol as much as possible.

“The idea is if I am having a backyard BBQ, I don’t want to have one and get high. I want to have one while I cook burgers. Have one while I eat. Have another while chatting with my friends. The idea is to be able to mimic traditional beverage alcohol,” he said. “Some people will have one glass and that’s enough. Other people will have three or four. That’s why we think this is disruptive.”

Jeff Maser, chief executive officer at the California-based The Tinley Beverage Company (TNY.CN)(TNYBF), plans to bring his lineup of alcohol-inspired cannabis drinks to Canada in early 2019. He sees growing demand for pot drinks in the U.S., particularly in the lower-dose category, but feels two milligrams of THC per serving won’t pack enough punch.

“Personally, I think it’s too weak. But I get where they are coming from,” Maser told Yahoo Finance Canada. “People’s tolerance builds pretty quickly when it’s going from zero. Two milligrams will really start to feel like nothing if they get repeat customers for their drinks.”

He expects many of the early criticisms of U.S. pot drinks, high price and inconsistent experience, will fall by the wayside as the category matures. He said his ready-made cannabis cocktails currently sell for $6 per single-serve bottle. That falls to $3.50 for multi-serve formats that mimic a bottle of liquor.

“We’d like to get that down. That’s why we’re investing so heavily in infrastructure and a big bottling facility just like Tweed has,” Maser said. “Infrastructure is the next catalyst for industry growth.”

Canopy Growth said it aims to price its products in the same range as alcoholic beverages in Canada.

While Tinley has product rolling off its bottling lines, Canopy Growth’s facility isn’t fully licenced by Health Canada, and therefore cannot have a single bud from the pot growing facilities across the street inside the building. Chief executive officer Mark Zekulin downplayed the risk of a supply shortage akin to what happened when recreational cannabis was first legalized on Oct. 17, 2018.

“I think you will see a much more reliable supply of products, not just from us but from the sector all around,” he said. “We’ve had a little bit more time to prepare this time around.”

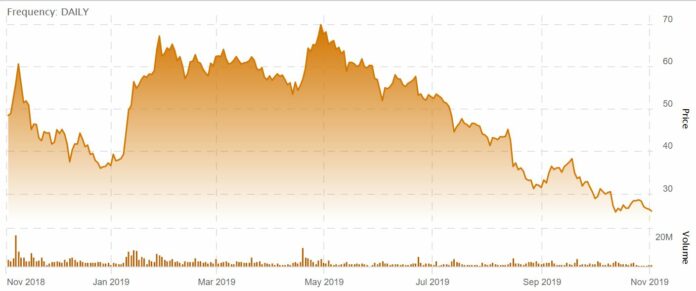

The stakes are high for Canopy Growth when it comes to selling higher-margin products that could boost the appeal of cannabis to those who may not want to smoke dried flower. The company is under mounting pressure from investors following a string of quarterly losses and concerns about overspending.

The 150,000 square foot beverage plant was built with open space to add future capacity. How much is ultimately put to work will depend on Canada’s thirst for cannabis.

“I think overall you can’t ignore what kind of exciting proposition this is,” Zekulin. “How much it seizes on day one versus day 100, we’ll wait to see.”