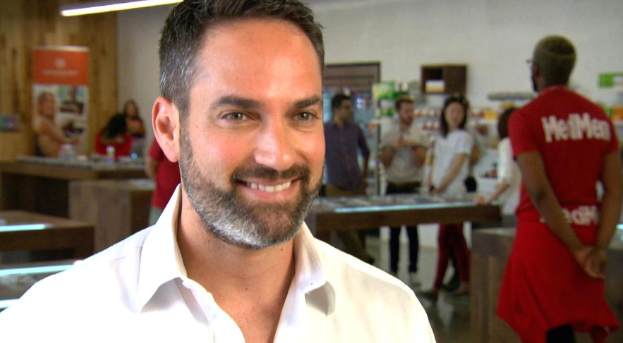

Adam Bierman has transformed MedMen into a marijuana industry powerhouse — despite ruffling feathers along the way

by Omar Sacirbey

(MJBizMagazine.com) On a recent June afternoon, MedMen CEO Adam Bierman fielded questions from 47 deep-pocketed investors seated at white-cloth tables inside Manhattan’s swank 21 Club.

His goal: raise money for a new $250 million cannabis investment fund MedMen launched on June 15.

During the luncheon, Bierman laid out the firm’s vision of acquiring or making investments in undervalued medical marijuana businesses in markets with many patients – but a limited number of licenses – in order to gain an early mover advantage. Bierman and MedMen expect those deals will generate a minimum annual return of 30%. Among the investors – representing wealthy individuals, family offices and institutional firms – a dozen liked what they heard. They began the process of investing in the fund, a procedure that involves signing nondisclosure agreements, receiving prospectuses and other steps.

The scene shows just how far Bierman has come in the marijuana industry since he and a partner scraped together $13,000 to launch a medical marijuana dispensary in a seaside California town in 2010. A couple of years later, Bierman and Andrew Modlin officially founded MedMen as a consultancy and then built it into a well-capitalized, talent-stacked marijuana business management firm that today owns or has stakes in seven MJ companies in three states and Canada. In 2016, MedMen launched its first private equity fund, which closed to new investors in April after raising $60 million.

How has Bierman – together with Modlin – done it?

- He’s been a master of reinvention, willing to change plans and business models at the drop of a hat to seize an opportunity.

- He implemented a savvy hiring strategy, filling MedMen with talent from established mainstream companies such as BlackRock, Capitol Music Group, the Los Angeles Times and Monsanto.

- He donates to the Marijuana Policy Project 1% of the money MedMen receives from fund investors, making him a major financial backer of pro-legalization efforts; that has earned Bierman new legitimacy and powerful friends.

- He’s overcome a brash, controversial style that has offended some marijuana business veterans who label him as a greedy, hype-over-substance opportunist who doesn’t respect them or the plant.

The 35-year-old Bierman, a businessman first and foremost, has no regrets.