“This is a transformative acquisition that will create the largest U.S. cannabis company in the world’s largest cannabis market,” Adam Bierman, MedMen’s chief executive officer and co-founder, said, referencing the California industry, in a news release.

(We remember this kind of activity in the dotcom boom – in particular, Mark Cuban’s Broadcasting.com being acquired for $5.7 billion in stock when it had $20 million in sales, forget profits. Cuban rather promptly and wisely exited his position in Yahoo. We wonder if the companies being acquired today will be as clever?)

MedMen Founders To Forfeit Equity Awards Unless Stock Exceeds C$10

MedMen Doubles Market Reach with Acquisition of PharmaCann

- MedMen to acquire PharmaCann in all-stock transaction valued at US$682 million, the largest acquisition transaction in U.S. cannabis history.

- The acquisition doubles the number of states where MedMen has licenses to 12.

- The combined addressable market in these 12 states accounts for over 50 percent of the total estimated 2030 U.S. addressable market of $75 billion, according to Cowen Group.

- Combined, MedMen and PharmaCann would be licensed for 66 retail stores and 13 cultivation and production facilities, including pending acquisitions by MedMen.

- PharmaCann unitholders will own approximately 25 percent of the pro-forma company, on a fully-diluted basis, at closing.

All dollar values are in U.S. dollars, unless otherwise noted.

LOS ANGELES–(BUSINESS WIRE)–MedMen Enterprises Inc. (“MedMen” or the “Company”) (CSE: MMEN) (OTCQB: MMNFF) (FSE: A2JM6N) and Chicago-based PharmaCann LLC (“PharmaCann”) announced today that both companies have signed a binding letter of intent (the “Agreement”) for MedMen to acquire PharmaCann in an all-stock transaction valued at $682 million.

“PharmaCann has built highly-efficient cultivation centers and dispensaries to promote a better quality of life for medical marijuana patients

The resulting pro-forma company (including pending acquisitions by MedMen) will have a portfolio of cannabis licenses in 12 states that will permit the combined company to operate 79 cannabis facilities. The combined company will operate in 12 states, which comprise a total estimated addressable market, as of 2030, of approximately $40 billion according to Cowen Group. Through the transaction, MedMen will add licenses in Illinois, New York, Pennsylvania, Maryland, Massachusetts, Ohio, Virginia and Michigan.

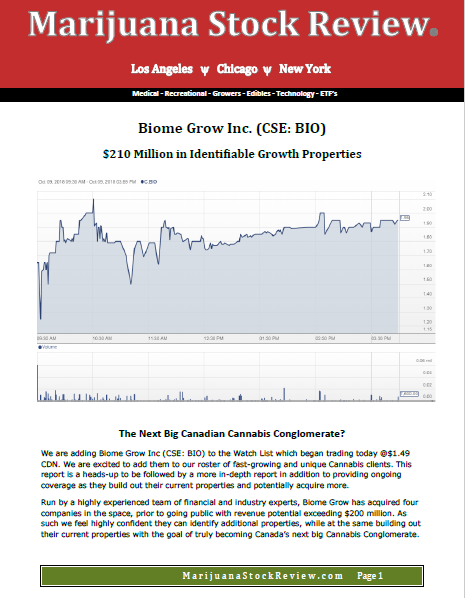

(Report on Biome Grow CSE:BIO $1.20)

“This is a transformative acquisition that will create the largest U.S. cannabis company in the world’s largest cannabis market,” said Adam Bierman, MedMen’s chief executive officer and co-founder. “The transaction adds tremendous scale to our vertically integrated business model by expanding our U.S. retail footprint across important growth markets while strengthening our cultivation and production capabilities. With the revenue synergies that the deal is expected to produce, MedMen is well positioned to continue executing on our growth strategy. This would not have been possible even two years ago and is a testament to how far both the industry and these two companies have evolved. PharmaCann’s leadership has built a world-class organization, and we are excited about the value this transaction is creating for shareholders.”

Founded in 2014, PharmaCann is one of the largest medical cannabis providers in the U.S. It currently operates 10 retail stores and three cultivation and production facilities across multiple states, including New York, Maryland and Massachusetts, and in Illinois, where it is the largest holder of medical cannabis licenses. The company also owns licenses for retail stores in Pennsylvania, Maryland, Massachusetts, Ohio, Virginia and Michigan, and cultivation and production licenses in all of its markets, excluding Maryland. PharmaCann is known for its high-quality cultivation and production and has one of the best track records in the industry for cannabis license applications.

“PharmaCann has built highly-efficient cultivation centers and dispensaries to promote a better quality of life for medical marijuana patients,” said Teddy Scott, Ph. D., PharmaCann chief executive officer. “This acquisition validates the dedication and level of sophistication we have used to provide consistent patient outcomes. I am proudest of the top-notch team we have assembled here and their dedication to our mission of serving medical marijuana patients. Our organization is a natural fit for MedMen, and we are excited to join a leading enterprise with a best-in-class management team.”

MedMen currently operates 14 retail stores in the primary markets of California, Nevada and New York. The Company recently acquired a license to open and operate 30 retail stores in Florida and has signed binding agreements to acquire an operating retail store in Illinois, cultivation and retail operations in Arizona, and an additional non-operating retail license in California. The Company has cultivation and production facilities in Nevada and New York, and is building facilities in Desert Hot Springs, California and outside Orlando, Florida. PharmaCann is licensed for 18 retail stores in eight states and eight cultivation and production facilities in seven states. Combined, the two companies will be licensed for 66 retail stores and 13 cultivation and production facilities (including pending acquisitions by MedMen).

| Licensed Facilities | MedMen | PharmaCann | Combined | ||||||

| Retail | 48 | 18 retail in 8 states | 66 | ||||||

| Cultivation & Production | 5 | 8 cultivation/production in 7 states | 13 | ||||||

| States | CA, NV, NY, IL, AZ, FL | NY, IL, MA, MD, MI, VA, OH, PA | 79 |

Strategic Rationale

- Creates Largest U.S. Cannabis Company by Market Reach with Best-in-Class National Footprint: The acquisition expands MedMen’s retail reach to a total of 12 states and gives the Company the ability to leverage the national brand equity it has built with its existing high-profile locations, such as Beverly Hills, Las Vegas and Manhattan’s Fifth Avenue.

- Strengthens Cultivation and Production Capabilities: Upon closing of the transaction, MedMen will have over 800,000 square feet of planned cultivation and production capacity in supply-constrained markets. The added capacity allows MedMen to accelerate the launch of its in-house [statemade] brand and to distribute its partner brands nationally. The combined company will be vertically-integrated in all markets in which it operates, with the exception of Maryland.

- Enhanced Infrastructure for Growth Initiatives: The combined platform bolsters MedMen’s infrastructure on the East Coast and Midwest to continue M&A and license application efforts in new attractive cannabis markets across the U.S.

- Revenue Synergies: Optimization of real estate strategy and product mix in stores has the potential to increase store traffic and basket sizes. The transaction capitalizes on MedMen’s retail brand reputation and PharmaCann’s added reach and production capabilities.

- Accretive to MedMen’s Wellness Platform: PharmaCann’s progress in medical-only markets will add further credibility to MedMen’s existing recreational-focused wellness platform.Read the full press release here.