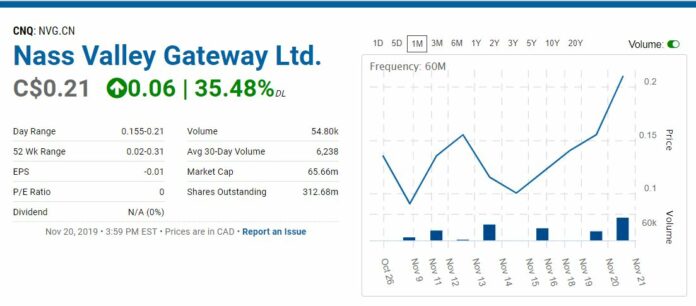

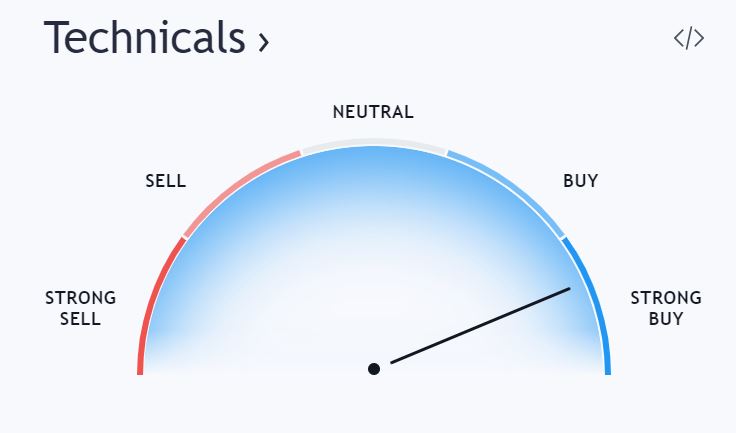

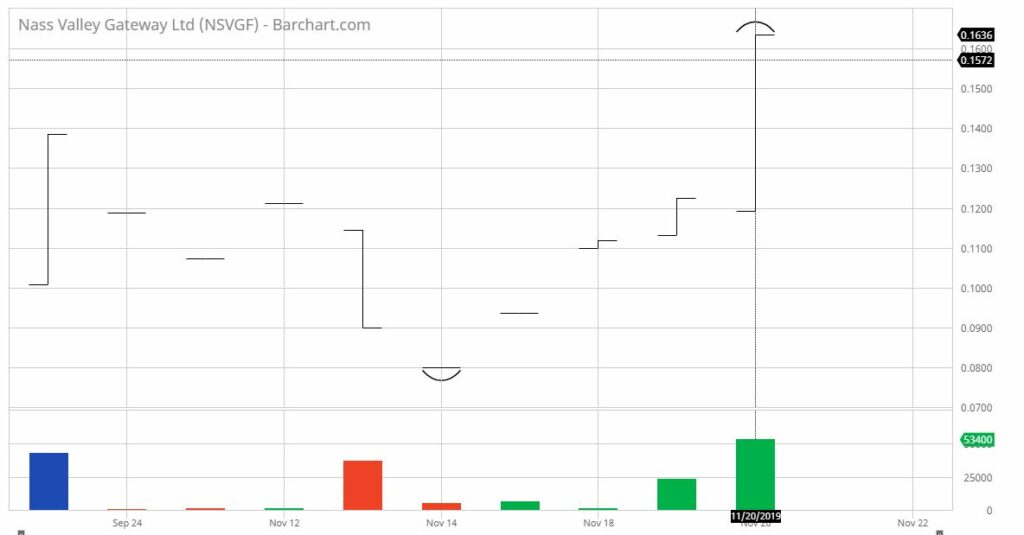

Shares of Nass Valley Gateway Have Turned up Recently on the Heels of News of an Expected Launch Date in Early Q1 2020.

We added Nass Valley (NVG.CN – NCVGF) to the Watch List on September 25th, 2019 at a price of $0.06, shortly after announcing a joint venture agreement with Dynamic Blending Specialists – a highly respected Utah based turnkey contract manufacturer of consumer cosmetic products.

READ MORE: NASS VALLEY ARTICLE ARCHIVE

A turnkey manufacturer means Dynamic can take an idea for a product from R&D all the way through the process to a finished market-ready product.

Dynamic has a dedicated team including chemists for formulation and marketing experts for packaging design and branding. Dynamic does everything in-house, with nothing being outsourced to assure quality control and safety – which is essential to all CBD related products, whether ingestible or topical.

Dynamic has won 4 different awards and was a finalist for ICMAD’s 2018 Innovative Company of the year at CosmoProf North America, winner of 6th Annual 2019 Globee® Awards and additionally has a highly regarded division that provides web design and search engine optimization, making it a perfect partner for Nass Valley.

Nass Valley Gateway is a diversified healthcare company that is focused to further expand the business of its acquired subsidiary Pro-Thotics Technology Inc. (“PTI”) which was established in 1988.

The Company is increasing its marketing of durable medical equipment products (DME-Business) on a national level, to encompass all states of the USA and other areas of North America and is aggressively developing the marketing, production and vertical integration of Cannabidiol (CBD) products without Tetrahydrocannabinol (“THC”) content for internal use including CBD infused skin, bath, and body care products of its wholly-owned subsidiary Advanced Bioceuticals Limited (“ABL”).

PTI is licensed to supply its products also to Medicare patients in the US and has established, over its more than 25-year history, a database of more than 200,000 patients, located throughout the U.S. and Puerto Rico, who were seeking wellness from pain relief.

Through its subsidiary ABL, Nass Valley is determined to expand upon this pain relief concept of its ABL-Business and to aggressively focus on the hemp-based CBD marketplace with a global market of $3.1 billion (New Frontier Data) and expand its current New Jersey operations internationally.

Nass Valley CBD products sales are planned to commence in early Q1 2020 under the “Nass Valley Gardens” brand via retail, wholesale, direct response, and digital sales channels. Nass Valley Gateway’s products will target the pain remediation, dermatology, anti-aging, and beauty markets.

With the signing of the joint venture between Dynamic Blending Specialists and Nass Valley the company now has the synergies of Dynamic’s proprietary formulas and products along with NVG’s significant customer database, call centers, and experience in direct response TV advertising campaigns.

Nass Valley is ready to create a fully integrated CBD enterprise via organic sales growth, strategic acquisitions, and by executing its business plan. The company believes it is on the way to becoming the leading CBD producer and supplier to retailers and wholesalers worldwide. The company’s products are formulated to be at the forefront of innovation and designed to be the benchmark of standards by retailers worldwide.

RECENT NEWS:

Nass Valley Gateway Ltd. Engages Investor Relations Expert Todd D. Sonoga.

Nass Valley Gateway Ltd. (CSE: NVG) (OTC Pink: NSVGF) (FSE: 3NVN) (the “Company” or “Nass Valley”) today announced it has retained Investor Relations expert Todd D. Sonoga, to spearhead our investment community awareness efforts.

“We’re impressed with Mr. Sonoga’s experience, resources, and relationships, as well as the results he’s achieved for other companies. We’re excited to be working with him,” stated Gavin Collier, Chief Executive Officer of Nass Valley Gateway. “In order to broaden our shareholder base, Mr. Sonoga will launch an investor awareness program that will effectively communicate our unique value proposition, as well as uniqueness in the marketplace and commitment to a consumer-centric business model; providing a consistent, high quality, and healthy experience for our customers to the investment community.”

Todd D. Sonoga is the former Sr. Executive and Assistant Editor for Wall Street Publishing (The Small Cap Report) and the general partner for Trilogy Marketing Strategies, LLC. Trilogy was a public relations firm specializing in consulting, raising market awareness, market support and identifying M&A targets for small cap companies. Mr. Sonoga is a Consultant, Investor and Entrepreneur. He founded Trilogy Marketing Strategies in 1998, Wall Street Micro Cap in 2013, Crowd Funding Power in 2014 and in January 2017, Mr. Sonoga assumed the role of Chief Marketing Officer and Co-Founder for WFN1 News Corp. and the radio show “CEO Money,” airing daily on IHeart’s Talk Radio 1190 AM Dallas/Fort Worth.

Mr. Sonoga has successfully represented public and private companies for over 20 years, consulting with them on market awareness, support, raising capital and identifying merger and acquisition targets.

“I am so impressed by the uniqueness of the company’s products, commitment and the dedication of the management team to deliver value to not only their customers and partners but equally as important their shareholders,” stated Mr. Sonoga.

INSTITUTIONAL

ANALYST INC.

NY

– CHICAGO – BEVERLY HILLS – DELRAY BEACH

ROLAND RICK PERRY, MANAGING EDITOR.

[email protected]

310-594-8062

Institutional Analyst Inc. and Revelers.IO Media Group Inc., Disclaimers: Past performance of other companies added to Institutional Analyst’s various newsletters or otherwise mentioned in its research reports, newsletters or communication is no indication of future performance of any current or future companies mentioned. This publication is a Corporate Profile and may not be construed as investment advice. This profile does not provide an analysis of the Company’s financial position and is not a solicitation to purchase or sell securities of the Company. Readers should consult their own financial advisors with respect to investment in this or any company covered by the Reviews. An independent financial analyst should verify all of the information contained in this profile with the profiled company. Institutional Analyst, Inc. the parent company of the Marijuana Stock Review is an investment research and public relations firm and associated firms have been compensated from the Company with five-thousand on a month-to-month basis for progress reporting. Revelers.IO Media Group Inc. is a web design firm which manages IA’s websites and digital initiatives. In preparing this profile, the Publisher has relied upon information released from the company, which although believed to be reliable, cannot be guaranteed. This profile is not an endorsement of the shares of the company by the publisher. The publisher is not responsible for any claims made by the company. You should independently investigate and fully understand all risks before investing in this and any company profiled or covered by the publisher. The majority of startup companies have factors, which create uncertainty about their ability to continue as a going concern. These concerns are typically related to dilutive toxic financing (or lack of), competitive environments, lack of operating history and operating at loss levels which is typical of most start-ups. These statements can be found in their most recent 10Q filings and should most definitely be read. Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: The statements which are not historical facts contained in this profile are forward-looking statements that involve certain risks and uncertainties including but not limited to risks associated with the uncertainty of future financial results, additional financing requirements, development of new products or services, government approval processes, the impact of competitive products or pricing, technological changes, the effect of economic conditions and other uncertainties detailed in the Company’s filings with the Securities and Exchange Commission. Impartial, we are not. Email: [email protected]