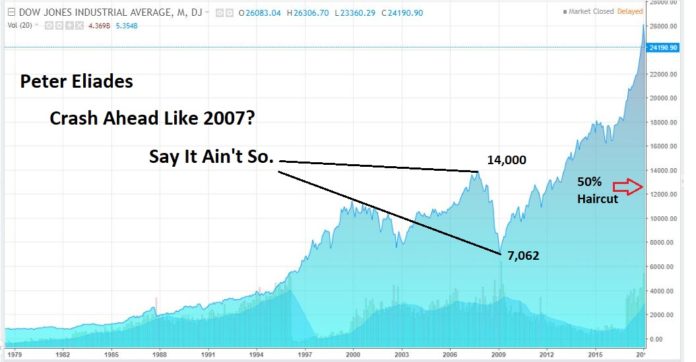

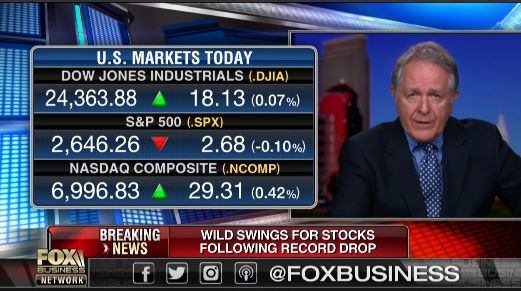

Feb. 06, 2018 – 7:45 – Stockmarket Cycles editor and publisher Peter Eliades predicts that the current stock market volatility could eventually devolve into a bear market last seen during the Great Recession in 2007.

A CLOSER LOOK AT 2007-2009

PRICE AND DATE STAMPED.

OUR LETTER IN 2008:

==================================================

Internet Stock Review Online, Thursday, 11/20/2008.

Chicago 30…42F. Sunny.

Los Angeles 51…76F. Sunny. (200)

==================================================

Table Of Contents:

1. On The Positive Side.

6. Disclaimer.

==================================================

Market just closed. We’re at 7500.

1. On The Positive Side.

Look at it this way, if we have another 10 days like this, we’ll be at

3250 on the Dow.

Another 17 days like this, we’ll be at zero. It could happen, ya never

know. And people might stop eating $0.99 cheeseburgers at McDonalds. They

could stop getting haircuts too. The history books 50 years from now,

might show that everyone had long hair in the early 2000’s, because of the

credit crisis. And we might reverse the trend in childhood diabetes. No

more fat kids — imagine that. “What, you want to supersize those fries ?

Get a job Johnny.”

We’ve turned off CNBC and are now watching Looney Tunes. Yosemite Sam…

And we’ve stopped going to the Stock Exchange (for this week). Going there

is like watching the auto bailout, on C-SPAN, on 20 year old Zenith TV,

eating Pickled eggs and Slim Jims with your buddies from the plant, in

Flint, Michigan and learning that all three of your leaders flew to

Washington on private jets. And yes we’ve been to Flint. You can still get

an honest drink there for $2.00. And the lap dances…we’ll we won’t even

go there.

The CNBC commentators can no longer hide the fact that their 401K’s which

are overweighted in GE stock, have nearly evaporated and they’ve actually

resorted to yelling at each other. One commentator even said “capitalism

has failed us.”

Walgeens (WAG) with fiscal 2008 sales of $59 billion and 6,544 drugstores

in 49 states is now at 10 times earnings. We were “value players” in the

early 80’s and could never pony up to Walgreens, because it was at 18

times earnings.

We have gotten to the point where you no longer need to be a good stock

picker (looking ten years out). You can actually just buy funds.

Big picture, advice wise. Don’t be too close to the financial crowd.

They’ll never tell you when to get back in (unlike us) while their black

AMEX card is being repossessed. It’s just too counter intuitive.

We still love Yahoo (YHOO) though we’re a little pissed about getting into

Google (GOOG) a bit early.

No one will outperform us in the next 2 years. No one.