Charlotte’s Web Announces Closing of its Previously Announced Underwritten Public Offering

Contrary to a Growing Popular Belief Suppoters are Apparently Still There!

BOULDER, CO, Dec. 3, 2019

/NOT FOR DISTRIBUTION IN THE UNITED STATES/

BOULDER, CO, Dec. 3, 2019 /CNW/ – Charlotte’s Web Holdings, Inc. (“Charlotte’s Web”, or the “Company”) (TSX:CWEB, OTCQX:CWBHF), the market leader in hemp CBD extract products, announces today that it has closed its previously announced underwritten public offering for aggregate gross proceeds to the Company of C$66,250,000 (the “Offering”). A total of 5,000,000 units of the Company (the “Units”), at a price of C$13.25 per Unit (the “Offering Price”) were sold pursuant to the Offering.

The Offering was led by Canaccord Genuity Corp., together with a syndicate of underwriters including Cormark Securities Inc., Eight Capital, and PI Financial Corp. (collectively, the “Underwriters”).

Each Unit was comprised of one common share of the Company (a “Common Share”) and one half of one common share purchase warrant (each full warrant, a “Warrant”). Each Warrant will be exercisable to acquire one common share (a “Warrant Share”) for a period of 2 years following the closing date of the Offering at an exercise price of C$16.50 per Warrant Share, subject to adjustment in certain events.

Charlotte’s Web has also granted the Underwriters an option (the “Over-Allotment Option”) to purchase up to 750,000 additional Units of the Company on the same terms as the Offering, exercisable within 30 days of the closing of the Offering.

Net proceeds from the Offering will be used primarily to fund the Company’s business development and for general working capital purposes.

The Units were offered in each of the provinces of Canada, other than Québec, pursuant to the Company’s base shelf prospectus dated April 8, 2019 (the “Base Prospectus”) and were also offered by way of private placement in the United States to “qualified institutional buyers”. The terms of the Offering are described in a prospectus supplement (the “Supplement”) dated November 27, 2019.

Copies of the Supplement and accompanying Base Prospectus may be obtained on SEDAR at www.sedar.com and from Canaccord Genuity Corp., 161 Bay Street, Suite 3000, Toronto, ON M5J 2S1. The Base Prospectus and Supplement contain important detailed information about the Company and the Offering. Prospective investors should read the Supplement, the Base Prospectus, the documents incorporated by reference in the Supplement and Base Prospectus, and the other documents the Company has filed on SEDAR at www.sedar.com before making an investment decision.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The common shares have not been and nor will they be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws. Accordingly, the common shares may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to exemptions from the registration requirements of the U.S. Securities Act and applicable state securities laws. This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities of Charlotte’s Web in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Charlotte’s Web Holdings, Inc.

Charlotte’s Web Holdings, Inc. is the market leader in the production and distribution of innovative hemp-derived cannabidiol (“CBD”) wellness products. Founded by the Stanley Brothers, the Company’s premium quality products start with proprietary hemp genetics that are responsibly manufactured into hemp-derived CBD extracts naturally containing a full spectrum of phytocannabinoids, including CBD, terpenes, flavonoids and other beneficial hemp compounds. Industrial hemp products are non-intoxicating. Charlotte’s Web product categories include CBD oil tinctures (liquid products), CBD capsules, CBD topicals, as well as CBD pet products. Charlotte’s Web hemp-derived CBD extracts are sold through select distributors, brick and mortar retailers, and online through the Company’s website at www.CharlottesWeb.com. The rate the Company pays for agricultural products reflects a fair and sustainable rate driving higher quality yield, encouraging good farming practices, and supporting U.S. farming communities.

Charlotte’s Web is a socially conscious company and is committed to using business as a force for good and a catalyst for innovation. The Company weighs sound business decisions with consideration for how its efforts affect its employees, customers, the environment, and the communities where its employees live and where it does business, while maximizing profits and strengthening its brands. The Company’s management believes that socially oriented actions have a positive impact on the Company, its employees and its shareholders. Charlotte’s Web donates a portion of its pre-tax earnings to charitable organizations.

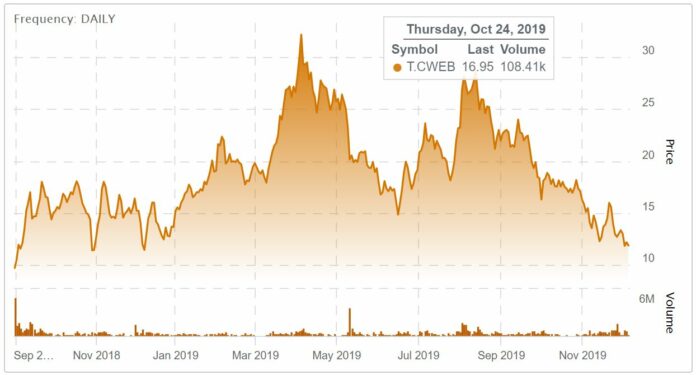

Shares of Charlotte’s Web trade on the Toronto Stock Exchange (TSX) under the symbol “CWEB” and are quoted in U.S. Dollars in the United States on the OTCQX under the symbol “CWBHF”. As of December 2, 2019, Charlotte’s Web had 58,572,809 Common Shares outstanding and 100,520.8075 Proportional Voting Shares convertible at 400:1 into Common Shares, for an effective equivalent of 98,781,132 Common Shares outstanding.

Forward-Looking Information

Certain information in this news release constitutes forward-looking statements and forward-looking information (collectively, “forward-looking information”). In some cases, but not necessarily in all cases, forward looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved”. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events. In particular, this news release contains forward-looking information relating to the Offering, the use of the net proceeds from the Offering, and any other information contained herein that is not a historical fact.

Forward-looking information is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date of this news release, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to the factors described in greater detail in the public documents of the Company available at www.sedar.com. These factors are not intended to represent a complete list of the factors that could affect the Company; however, these factors should be considered carefully. There can be no assurance that such expectations, estimates, projections and assumptions will prove to be correct. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company expressly disclaims any obligation to update or alter statements containing any forward-looking information, or the factors or assumptions underlying them, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE Charlotte’s Web Holdings, Inc.

View original content: http://www.newswire.ca/en/releases/archive/December2019/03/c3737.html

subscribe to Charlotte’s Web news, or contact: Cory Pala, Investor Relations, (416) 594-3849, [email protected]; Media Contact: Adam Schiff, CultureSpeed Communications, (917) 701-7800, [email protected] CNW Group 2019