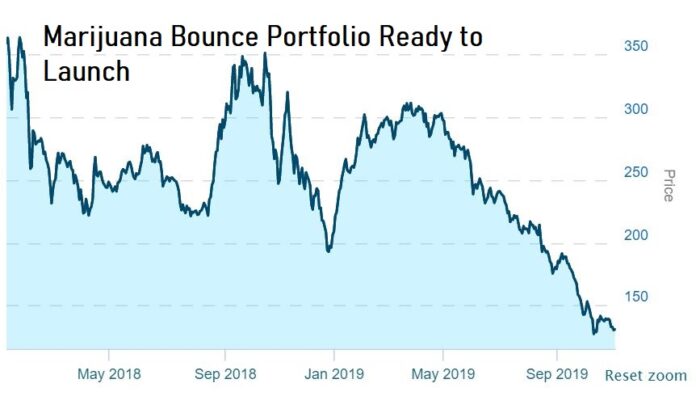

| MARIJUANA STOCKS WE’RE WATCHING. 1. Marijuana Bounce Portfolio – Top 20 Stocks for 2020. 2. Adding Tinley Beverage (TNY, TNYBF) to MBP Portfolio. 3. Adding Biome (BIO CN, BIOIF) to MBP Portfolio. 4. Adding Nass Valley (NVG CN) to MBP Portfolio. 5. Adding CLS Holdings (CLSH) to MBP Portfolio. 6. Adding Charlotte’s Web (CWEB) to MBP Portfolio. 7. Adding The Alkaline Water Company (WTER) to MBP Portfolio. 8. Toxic Marijuana Financings, Shortsellers & Bears, Oh My! 9. Disclaimer. Marijuana Stock Review – Bounce Portfolio – Top 20 Stocks for 2020. Okay, here’s a fun project idea we came up with a couple of months ago. We have been waiting for a correction like this. And now it’s as they say, no balls – no baskets time. “Be fearful when everyone is greedy and greedy when everyone is fearful.” Are you fearful you were duped – this was all just a big scam on the trusting public? Most of the financial portals will come out with their annual Watch Lists or favorite list in January, like clockwork. It sounds logical, but it isn’t. We prefer to issue a broad Watch List when we think the timing is right. Which could be March or even June. This is additionally why this is our first Watch List, even though we launched the Marijuana Stock Review a couple of years back. The timing, in our opinion is perfect, and now (or any day now lol). We’ve waited. And now the wait is almost over. Not that we’ve ever been able to pick an absolute bottom in any market or in any particular security, but we are generally close – give or take 10-15 percentage points. Another leg down may come, with the big names reporting right now, but we think enough is enough. The ref just called a break, everyone back to their corners and then let’s come back out swinging. We originally planned to list five large caps, five mid-caps and ten micros’ but the more we looked into the large caps, the more we thought – ah, maybe next year. So, the list will be quite eclectic with a goal to avoid companies near the end of their runway, cash-wise. We also found a couple of very interesting recently trading start-ups, that have yet to sell their first drop of tincture or the first sip of CDB enhanced beverage. Starting today is tougher than a year ago (raising money) but cream seems to always rise to the top, regardless of market conditions (Facebook 2004 after the dotcom crash). The list should be compiled and released this weekend. In the meantime, we’re coming out with subsector lists of our Top Pure Play CBD, Beverage, Dispensary and Vape plays. Which is very difficult to do, in that for some maniacal reason (maybe too much cash, or it simply looked good in the business plan), most Marijuana plays decided to go vertically integrated – so it’s hard to find any true pure plays. We liken what happened in the cannabis industry to an apparel maker (think t-shirts) feeling the need to grow their own cotton fields, build their own mega-textile mills, hire their own fashion designers and then open 50 stores across the Canada and the United States (MSO’s). Excuse us but WTF were they thinking? Companies can outsource all that and focus on sales and marketing. Does Nike make its own shoes, hell no? That’s what Vietnam is for. Our first list will be the Top CBD pure plays, which in our opinion is one of the best sectors for any one individual company with its act together to find success. A CBD company to us is either you process gallons and gallons for sale to others who put the CBD into consumer products or you sell end-use products. And yes, we recognize the black swan danger facing processors from synthetics who can crush the growers – being cheaper, cleaner and faster. A Pure CBD play is also a company that takes CBD (processed at home or purchased) and puts it into cleverly marketed products. Like companies taking a non-patented, low-cost commodity like CoQ10 and making their version seem special and raking in millions in the process. Companies that sell end-user products, can simply switch to the latest and greatest version of CBD and remain viable – so less worry about synthetics. EARLY ADDITIONS TO THE MARIJUANA BOUNCE PORTFOLIO (MBP) Adding Tinley Beverage (TNY, TNYBF) to MBP Portfolio. After a difficult Q2 in trading, Tinley snapped back trading from $0.30 to $0.40 on heels of the news they completed their Phase III THC infused (yes, THC) bottling plant on Los Angeles, then signed a deal to have a new line called Beckett’s carried in 150 CA-based BevMo stores, then signed a deal with Great North Distributing (established by Southern Wine $13 billion) to handle sales in Canada. A breaking taking month of progression. This is a client and our clear favorite in the sale of THC dinks, which we think will be a monster category. Imagine if, in the old days, you had to light up to get an alcohol buzz. Then one day some smart entrepreneurs figured how to put it in a can or bottle. It’s epic, it’s historic. Who wants to light up a Margarita? MBP price: $0.30 12 Million Bottling Plant Completed. Updating Coverage on Tinley (TNY, TNYBF) Beverage. Adding Biome (BIO CN, BIOIF) to MBP Portfolio. Our only grower Biome Grow has what we think is the best management team put together of any small, but highly ambitious grower. Their motto is ‘building tomorrow’s next conglomerate.’ Lead by former Wall Street marijuana magnate, CEO Khurram Malik – the company sports a very small $30 million market cap, despite signing an agreement announced in February that could represent close to $100 million in revenue per annum starting next year. The first shipment went out in February and they just reported numbers that show not only ‘can’ they produce revenues right out of the gate ($1.3M Q2) but that they ‘are’ producing revenues – with one of the four grow divisions already showing profitability. MBP price: $0.26. Adding Biome Grow, (BIO.CN, BIOIF) to “Marijuana Bounce Portfolio – Top 20 for 2020” Watch List. Adding Nass Valley (NVG CN) to MBP Portfolio. This is our ‘secret weapon’ start-up idea that we think can rise to the top of the charts, in revenue and stock performance. Why a secret? While we have met with management and looked at their business plan and were impressed enough to sign them as a client and add them to the Watch List at $0.06 in late September – information from Sedar filings can be harder to follow than SEC filings. More substantive info will soon be forthcoming. In the meantime, this is shaping up to be one of the few true Pure play CBD marketers. Sitting with management at Nass Valley made us feel like we were sitting with Mike Lindell from MyPillow when they were first launching in 2004. From a marketing standpoint, they just ‘get it.’ There were 1000’s of pillow makers in 2004, yet somehow Mike with five employees and his personable infomercials managed to show the established how to really sell pillows – with over 41 million sold. MBP price: $0.06. Adding NASS Valley (NVG.CN, NSVGF, 3NVN Berlin) to Marijuana Stock Review Watch List ($0.06). Adding CLS Holdings (CLSH) to MBP Portfolio. In short, currently at a run rate of $13 million and a market cap of $30 million, Canaccord (not a misprint, we checked three times) projected revenues of $147 million in 2020. Wait, what, $147 million? Do we need to read any more? The stock has fallen a high of $1.09 and has to fall under ‘why the hell not’ category of purchase decisions. Currently 583 potheads go in and out of their stores each day. Great 12-page report from Falcon Research posted on SeekingAlpha and reposted on our site. MBP price: $0.22. Marijuana Stock Review Adding CLS Holdings (CLSH) $0.22 to Watch List. Adding Charlotte’s Web (CWEB CN, CWBHF) to MBP Portfolio. Charlotte’s Web is what every CBD company wants to be when they grow up. Great marketing, good branding, and the luck to be featured on CNN in 2013 when no one had heard of CBD. It hasn’t cracked – cracked falling from $24 to $11, but it did see $1.2 billion shaved off its valuation now down to $524 million. The street carries a price target of $23 and since they are not a client, we can add a price target too. Ours is $25 just to be the highest on the street! If you believe in expanding CBD sales like we do, you have to believe in Charlotte. MBP price $13.25. Adding The Alkaline Water Company (WTER) to MBP Portfolio. If The Tinley Beverage Company is our favorite THC beverage maker, the Alkaline Water Company has to be our favorite client and CBD beverage (and more) maker. If there is a central belief, we have in the highly competitive CBD beverage market, it is that a company that has proven it can sell a non-CBD beverage, has an enormous leg up over its competitors in being successful in selling a CBD enhanced beverage. Simple fact of life. Slapping CBD on a label of iced tea, will probably not willy-nilly make it. In fact, the odds are probably 95% that it won’t. Hate to be a killjoy, but beverages are cutthroat and Alkaline Water has shined from near zero in five years to over $60 million next year. Alkaline Waters has succeeded where nine out of ten beverage start-ups fail. If they can prove success in selling water, which it has, they have proven they can sell, period. Second, companies that have an embedded fan base – are simply asking their current fans to ‘try our flavored’ or ‘try our CBD enhanced’ version. It makes the first try process enormously less complicated than getting a consumer to try something when they don’t even know what it tastes like. We are long overdue (or perfectly due) for an updated report on the amazing progress the company has made in the past year, including now being associated with two of the wealthiest entertainers in the US: P Diddy (net worth $740 million) and Mark Wahlberg ($255 million). Not because they hired them, but because they bought their fast-growing water company Aquahydrate. Oh and Yucaipa now owns 18% of Alkaline Water. It’s run by Ron Burkle who has a net worth of $1.5 billion. The share price ran to a high near $5.00 in the height of the CBD craze and is now at its most favorable valuation since we began following it three years ago. Adding the Alkaline Water Co., (WTER) $1.47 to Marijuana Bounce Portfolio. We’ll get started on that report tonight! MBP price: $1.47. Toxic Marijuana Financings, Shortsellers & Bears, Oh My! Great, yet spooky plain talk from Equity.Guru. The only thing which spooks us about bargain hunting at these levels is this: When a stock (think Tilray) trades from $1 billion to $5 billion, it loosens the wallets of those shareholders to play with the small caps. On the flip side, when it falls like it just has, the wallets and small cap experimentation tightens up. Some investors refer to it as a ‘bad taste’ in the mouth. So, if Tilray trades to $4 as some have predicted – it will make life very tough on the companies above. Just saying. “Currently, Canopy Growth Corp (WEED.T), the big bellwether of the cannabis sector, has over a billion dollars in short selling bets against it. Aurora (ACB.T), which is also up there in market cap and name recognition, is close to the billion mark in shorts. There are $4.5 billion in short bets in weed right now which is a lot considering the widely used estimate on the size of the cannabis industry has been $5 billion in Canada.” Toxic Marijuana Financings, Shortsellers & Bears, Oh My! |

Marijuana Bounce Portfolio: Are You Ready?

SourceMSR

RELATED ARTICLES